Spend Analytics

Purchase Price Variance (PPV) – It is Really Simple

No matter the industry, managing spending is always a fundamental focus for any executive team, and nothing impacts spend as much as variation in the purchase price of goods and services. Purchase price variance (PPV) is one of the key metrics – arguably the most important metric – used by procurement teams to measure the variation in the price of purchased goods and services. It is a prime measure of how effective the procurement team is in delivering cost savings to the enterprise.

What is Purchase Price Variance (PPV)?

Purchase price variance (PPV) is the difference between the actual purchased price of an item and a standard (or baseline) purchase price of that same item. It is assumed that the product quality is the same and that the quantity of the items purchased and the speed of delivery does not impact the purchased price.

The actual purchased price is how much the enterprise actually spends for that item, whereas the standard (aka baseline) purchase price refers to a price that procurement specialists believe the enterprise will pay for the item during the planning or budgeting process.

Often standard/baseline purchase price is based on the prior year’s last purchase price (LPP), the current years’ first purchase price (FPP), or some other price developed given best facts and circumstances available when the standard was created.

How to Calculate Purchase Price Variance

When calculating PPV, follow this formula:

PPV = actual quantity x standard price – actual quantity x actual price

Let’s take a look at a simple example. You need to purchase 100 hand-held scanners for your company and each scanner has a standard price of $500. The actual price you pay for each scanner is $490, which is $10 less than planned.

The purchase price variance then is the actual quantity (100) x standard price ($500) – actual quantity (100) x actual price ($490) = $1000, meaning that you saved $1000 on the purchase.

100 x $500 – 100 x $490 = $1000 PPV

Interpreting Purchase Price Variance

If the actual price is lower than the standard price, the enterprise has a favorable price variance for that item, meaning you’re saving money for your organization. Yay!

If the actual price is higher than the standard price, then the enterprise has an unfavorable price variance for that item, which means you’re spending more for the item. Uh oh!

In a nutshell: a favorable variance means the actual costs are lower than budgeted, whereas an unfavorable variance means that the actual costs are higher than budgeted.

Related: Why does maverick spend occur?

What Causes Variance in the Purchase Price?

Variances in the purchase price can be caused by many factors.

A favorable purchase price variance is considered savings generated by the procurement organization. Great work – this means your company is effective in getting more favorable pricing than anticipated from the supplier! Some reasons for this might include:

- The procurement team is negotiating better pricing deals

- You utilize superior procurement strategies and practices, like gathering bids from multiple suppliers

- There’s an overall decrease in material price

- You’re receiving a purchase discount due to large orders

- The purchased product is of a lower quality than the standard, leading to a lower price

An unfavorable purchase price variance, however, means that the actual cost is higher than the standard cost, which is not something you want to see. This can happen because:

- There’s an overall increase in the market price for the material

- The purchased products are of higher quality

- Your bargaining power has decreased

- There’s a loss of discounts due to smaller orders

- The procurement team is making inefficient buying decisions

Why Should You Use a Standard Purchase Price?

The rationale behind using a standard price, especially in manufacturing entities, is that direct material purchases can routinely make up 70% of all the costs. Hence, budgeting and tracking standard vs. actual prices is a key task of many procurement and finance professionals as it is a critical metric for effective decision-making.

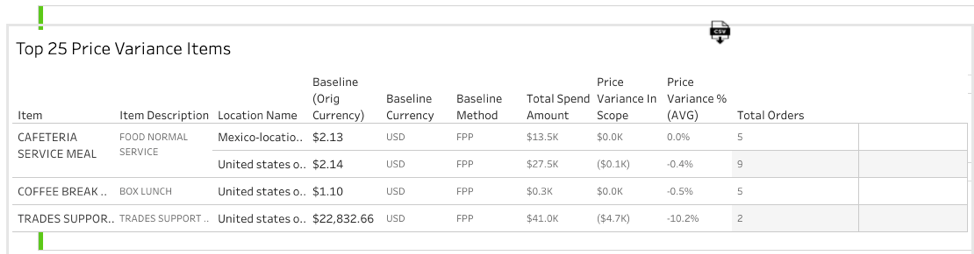

Tracking PPV with Xeeva Spend Analytics

Xeeva Spend Analytics makes it easy to track purchase price variance. As one of the targeted insights visualized on our intuitive spend dashboards, you’ll be able to identify variances that are most impactful to your bottom line, quickly see how prices vary, and make it a routine practice to track as your company keeps generating more spend.